What is the impact of customer destocking?

2024-05-09

News on May 7: According to industry insiders, with the overseas destocking coming to an end, the textile manufacturing sector will collectively show a month-on-month improvement in revenue and profit growth in the second half of 2023, especially in contact with terminal brands. The most direct and close links of accessories, ready-made garments, and finished shoes have collectively shown significant revenue growth and profit margin improvement.

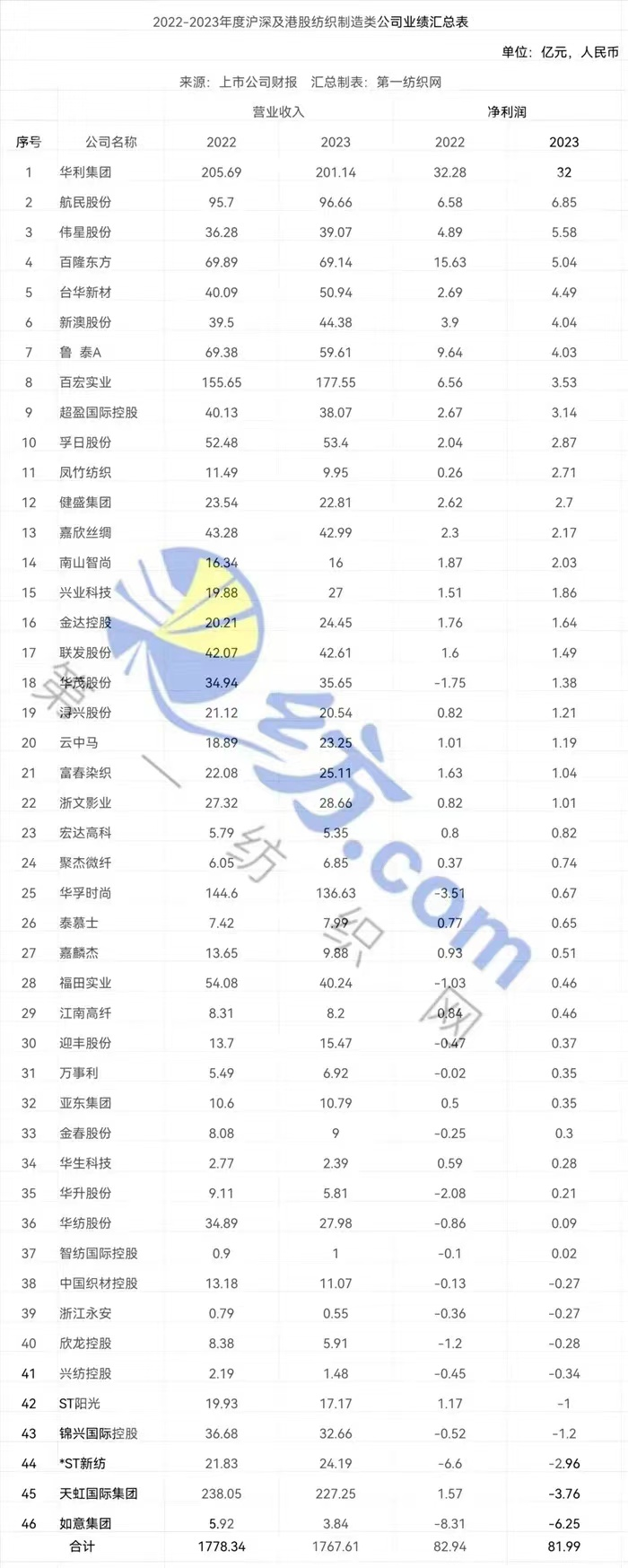

According to the monitoring statistics of the First Textile Network, in 2023, 47 Shanghai, Shenzhen and Hong Kong-listed textile manufacturing companies achieved a total operating income of 176.761 billion yuan, an increase of 1.073 billion yuan compared with 177.834 billion yuan in the same period last year, and a total net profit 8.199 billion yuan, an increase of 95 million yuan compared with 8.294 billion yuan in the same period last year.

Summary table of performance and product sales of 47 listed textile companies in 2023

Looking forward to the whole year, taking into account the progress of inventory reduction by downstream brands, current orders and performance of manufacturers, Yang Ying predicts that the revenue of textile manufacturing companies in 2024 will increase rapidly year-on-year with strong certainty, and the capacity utilization rate is expected to improve significantly year-on-year. Driven the rapid growth of the company's annual performance in the sector. Considering the current uncertainty in global downstream terminal consumption, it is expected that brand customers will be relatively cautious in judging future growth and at the same time have a more flexible order rhythm. The subsequent order growth of textile manufacturing companies still needs to continue to be tracked.