Automatic Drawing-in Machine “Steps Into” Denim Mills

2025-09-09

At 2 a.m. the lights in Zhixing Denim’s smart plant are still on, but the familiar clatter of the drawing-in room is gone. Twelve automatic drawing-in machines glide along rails; a robotic arm finishes one “pick-up – heddle – reed” cycle in 0.3 seconds. Eight harness frames, 4,800 warp ends, are threaded in only 35 minutes. Technician Li Hao taps the screen to confirm “zero broken ends, zero mis-draws”, and the next roll of deep-indigo stretch denim is cleared for weaving.

“Twenty skilled operators used to spend five hours bent over the job and we still lived with a 1 % error rate. Now one pass reaches 99.2 %, so we can finally accept quick-response orders from premium brands,” says Wang Cheng, the mill’s production GM. One automatic unit threads 140 ends per minute, 20 hours a day – 168,000 ends, equal to the output of 7.5 workers on three shifts. With an average local wage of 80,000 yuan a year, labour savings amount to roughly 600,000 yuan per machine; add the upgrade value from the 0.8-percentage-point fall in defects and the mill’s annual direct benefit tops 1.1 million yuan, cutting pay-back to 2.5 years.

Warp ends – the skeleton of denim – must be drawn through drop-wires, heddles and reed before weaving to guarantee clean shedding and sharp pattern. Manual work with tweezers is prone to “missed ends” or “wrong draws”, creating un-repairable bars or skips that appear only after washing. Industry data show drawing-in errors account for 42 % of early-stage denim defects, a long-standing invisible threshold.

“Automatic drawing-in machines are not new, but early models handled only combed plain weaves of 40 Ne and finer; they were helpless with the coarse, two-ply, slub, stretch cocktail typical of denim,” explains Chen Nan, expert at China Textile Machinery Association. In 2020 a consortium formed by loom builder Zhizhi Technology, Donghua University and Huafang Denim solved three bottlenecks:

Vision: a 16 k line-scan camera plus AI edge algorithm can distinguish indigo slubs from normal yarn at ΔE ≤ 1, eliminating wrong draws.

Tension closed-loop: single-end tension is sensed and servo-compensated within 0.02 s, keeping stretch elongation at ±0.5 % and preventing loose/tight ends.

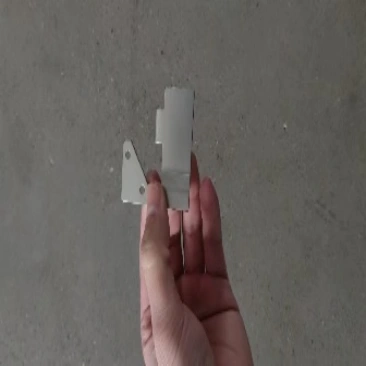

Modular grip: 0.8 mm ultra-thin ceramic-coated inserting hook handles 3–16 Ne coarse two-ply yarn with a service life of 30 million cycles.

After three iterations the latest ZG-J12 automatic drawing-in machine owns 85 patents (27 invention) and has been rated “internationally advanced” by the China National Textile & Apparel Council.

China produces about 6.5 billion metres of denim a year – 60 % of the world total – but most is mid-low-end OEM priced under US $2 per metre. Brands such as Zara, Levi’s and Li-Ning now demand 15-day quick response, making the old “manual + bulk” model unviable.

“Cutting lead-time in half means the drawing-in stage must be same-day and fault-free,” says Xu Zhiyong, chairman of Guangzhou Xinsheng Denim. After installing four automatic units in March, the mill can deliver 8,000 m of positioned-pattern denim in only three days; selling price rose to US $4.2 per metre and profit margin gained six points. Customs figures show the average export price of “≥3 % stretch premium denim” from Guangdong ports gained 12.4 % year-on-year in January–July 2025; 70 % of those shipments came from plants equipped with automatic drawing-in.

Localisation of upstream parts has also taken off. Zhizhi’s supply-chain centre says more than 80 % of cameras, servos and linear guides are now sourced domestically; Guangzhou and Foshan alone have attracted over 30 new tier-1 suppliers worth more than 1.5 billion yuan in annual output. As volumes grow the ex-works price of an automatic drawing-in machine has fallen from 4.8 million yuan in 2019 to 2.6 million today, putting the technology within reach of small and medium mills.

Power savings are equally visible. Manual operation requires repeated lifting and slewing of beams, consuming about 1,200 kWh per tonne of yarn. The new “fixed-point threading” layout cuts this to 950 kWh; applied to the national consumption of 4.5 million tonnes of warp yarn the saving is 1.125 billion kWh, equal to 920,000 t of CO₂.

“We are linking drawing-in data to dye-house recipes so that every yarn’s origin, lot and tension profile is sent to the indigo bath in real time, cutting indigo waste by 5 %,” reveals Zhou Kai, R&D director at Zhizhi. The next-generation ZG-J13, due in 2026, will integrate “drawing-in – on-line inspection – MES cloud” modules, targeting 99.5 % first-pass yield and enabling 10,000 m² of fabric split into 100 small orders to be shipped in seven days – a “green flexible” model.

The China National Textile & Apparel Council’s 2025 Denim Equipment Outlook puts national ownership at about 2,200 automatic drawing-in machines – only 25 % penetration. By 2027, as prices slip below 2 million yuan and RCEP tariff favours order reflux from South-East Asia, penetration is expected to hit 55 %, pushing market value above 30 billion yuan.

“Whoever first unmans the drawing-in stage gains pricing power,” Chen Nan concludes. The automatic drawing-in machine is no longer just a piece of hardware; it is the entry point to full-chain digital, green transformation. Once its data are connected with spinning, dyeing, weaving and washing, the “traditional” 100-billion-yuan denim track may finally reach the inflection point of true smart manufacturing.